On the tenth floor, perched high above the University of Colorado, Boulder campus, teeming with young minds, running eagerly between classes is the office of physics professor, Dr. Jerry Peterson, Ph.D. His office is quaint but every inch of it is covered. Books line shelves and table tops, papers and binders are stacked high on two separate desks, graphs and charts hang on the walls and sitting atop one of his bookshelves are Geiger counters and a Safeway bag filled with uranium ore.

“Come on in, check out my view,” he says to me. Through the only window in the office, he looks out onto the beauty and simplicity of the flatirons that stretch across the Boulder horizon. It is the perfect juxtaposition to the chaos of his office and the nature of his study.

Dr. Peterson is a renowned expert on nuclear power and served as a Jefferson Science Fellow to the State Department. While his primary duty now is advising students, Peterson spent the latter part of his career advising U.S. officials and members of the intelligence community on issues and ideas pertaining to coal, nuclear energy and the environment.

His capstone class, Technology and Global Security, examines nuclear weapons, information and climate change as phenomenon and technical origins and fixes for problems that his future leaders will face in their careers. He teaches them not so that they know the details but so that they know enough to examine the impacts.

“There is nothing taught about nuclear weapons on this campus except for in my class,” Peterson says, “There is a lot of distaste, especially amongst the educated, for the idea of nuclear weapons or anything nuclear for that matter.” He is clear that people would have a better understanding about the ideas, the issues and the element if people could transmit just enough relevant information about the subject to get their point across.

“People need just-in-time information,” but stressed that, “Public opinion is too often swayed by headlines and less about the facts.” Inherently, with the nature of uranium and the recent attention grabbing headlines like the nuclear fuel meltdown at Fukushima Daiichi, Peterson is sure that people will continue to have a skewed perception about uranium and the nuclear industry.

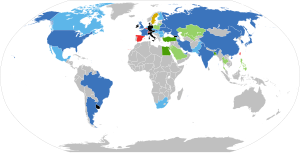

In lieu of the Daiichi disaster, the industry experienced a substantial setback as prices were validated on growth in the industry. And while there are currently 433 nuclear reactors actively burning uranium in 30 countries worldwide, the market is still shaky from many worldwide economic variables.

Miningweekly.com quoted junior CanAlaska executives who said the industry had reached “the bottom of the trough” and that there would be “a wave of buying.” The decline stands in contrast to the desire by many to have access to carbon free energy sources. The demand is seen in areas that rely heavily on air-conditioning which in turn generates a greater demand for energy growth to existing grids.

“As a 50 percent worldwide urban population, we are more separated from the fundamentals of supply than ever before,” he says, “We’ve created highly engineered complex systems to stay efficient, but that same efficiency we’ve created holds intrinsic dangers." That same efficiency has led us to be unprepared for energy demands that regardless of what people think, are vital to the cog of America and every corner of the planet.

While green energy has pushed its way to the forefront of many industrialized nations and is even spreading into developing nations as well, it has not evolved enough to slow the use of other natural resources that still face increasing demands. Peterson knows this.

The inherent contrast of Peterson’s life is what makes him so fascinating. On one hand he lives in Colorado where the landscape dominates the forefront of people’s minds, however he understands the barriers and opportunities that exist within the energy sector, especially nuclear. As an element that provided roughly 13.5% of the worlds energy last year, according to the Nuclear Energy Institute, it is clear that regardless of people’s fears and environmental concerns, plants will continue to burn uranium.

“Of all environmental hazards it (nuclear) is by far the easiest to detect, you don’t need complicated chemistry. It is an in your face notification of its hazard. Far, far more dangerous and harder to detect is mercury; at very small concentrations it is very hard to measure. Uranium, even at a level far from hazardous clicks loudly and gives you a number on a meter and you know all about it,” he informs me.

Like other natural resources, it is important for individuals to understand the process along with the pros and the cons of extraction and production. As the industry remains hard hit there is still a new market for nuclear power. “It’s been done before, but its the use of smaller reactors. The military did it years ago running radar stations,” he reminds me, “These new kinds of nuclear reactors are smaller, sealed and self-contained. It’s a way for remote mines, oilfields and areas with a weak grid, even small towns to receive more energy.”

Peterson at this point brought me full-circle. In just under an hour and a half he ran through history, talked about implications and gave a clear understanding about the facts of uranium and nuclear’s certain future. At this point I understood the evolution of our conversation and was clear why as a prominent nuclear physicist, he is a leading CU professor and once a Jefferson Science Fellow. He’s relatable.